change in net working capital meaning

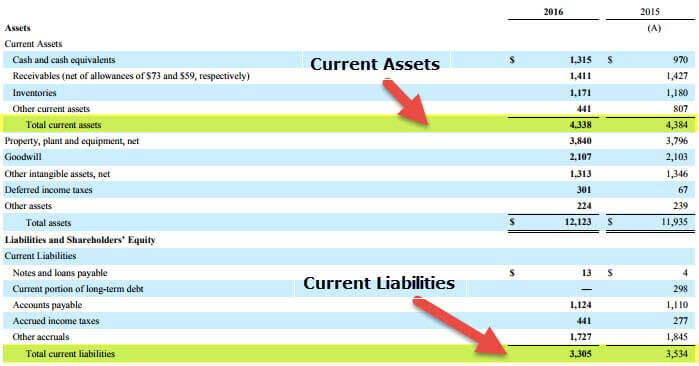

Accounts receivable Inventories - Accounts payable. They view the funds available to a business enterprise as its working capital Working capital is defined as current assets minus current liabilities and thus is a broader definition of.

Changes In Net Working Capital All You Need To Know

The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period.

. Generally a 21 ratio of current assets to current liabilities is considered to be an adequate amount of net working capital. Net operating working capital. When changes in working capital is negative the company is investing heavily in its current assets or else drastically reducing its current liabilities.

Net operating working capital NOWC is a financial metric that measures a companys operating liquidity by comparing operating assets to operating liabilities. Sometimes an increasedecrease in working capital will not give the exact picture. The ratio measures a companys ability to pay off all of its working liabilities with its operational assets.

The change in net working capital showcase if your short-term business assets is improving or perhaps decreasing with regards to their short-term liabilities from a one time period to the next. The reduction of working capital means that organizations are able to maintain and duly manage their resources in the sense that they are able to settle their debts in time while ensuring a quick recovery track record from the company. The terms working capital and net working capital can be used interchangeably here.

Thats where the change comes into play. Net working capital is defined as current assets minus current liabilities. Changes in Net Working Capital means changes in accounts receivable adjusted for non - cash items plus changes in inventory adjusted for long - term and non-cash items less changes in accounts payable adjusted for royalties and rebates.

Changes in Net Working Capital. The cash flow statements informally named changes in working capital section will include some noncurrent assets and liabilities and thus excluded for the textbook definition of working capital as long as they are associated with operations. If the change in NWC is positive the company collects and holds onto cash earlier.

However if the change in NWC is negative the business model of the company might require spending cash before it can sell. Change in Working Capital means for any period the increase or the decrease of the difference between current assets net of cash and current liabilities net of short term debt and the current portion of long term debt as reflected on the Borrowers consolidated balance sheet delivered to the Agent and the Lenders pursuant to Section 91 or 93a of the Loan Agreement. The Change in Working Capital could positively or negatively affect a companys valuation depending on the companys business model and market.

Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should not lie idle in future. There is no standard formula for how to calculate the NWC and every transaction is unique in this regard but any calculation must have regard to both timing and content. However accountants and financial executives think of funds in a broader sense.

So higher the current assets or lower the current liabilities higher will be the net working capital. What is the definition of NOWC. Working capital also called net working capital NWC represents the difference between a companys current assets and current liabilities.

Any change in the Net Working Capital refers to the difference between the Net Working Capital of two executive accounting periods. If you just want the definition of net working capital NWC its simply. This is because an increase in the Net Working Capital would mean additional funds needed to finance the increased current assets.

You want this number to be as low as possible. In here you want to substract Current liabilities net of debt to current assets net of cash. Subtle difference with the one above.

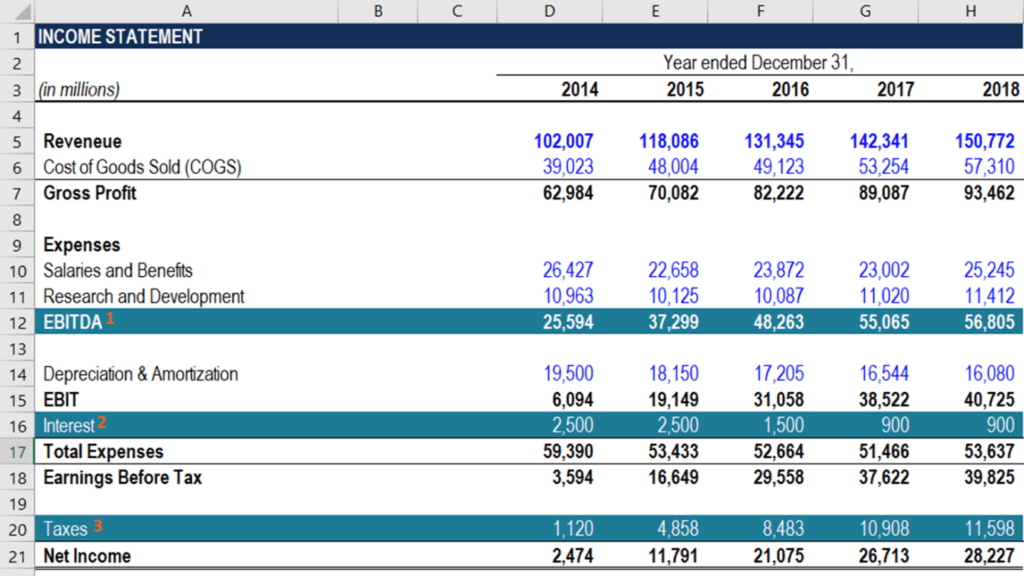

Changes in net working capital impact cash flow in financial modeling. In common usage the term funds means cash. Meaning of Working Capital.

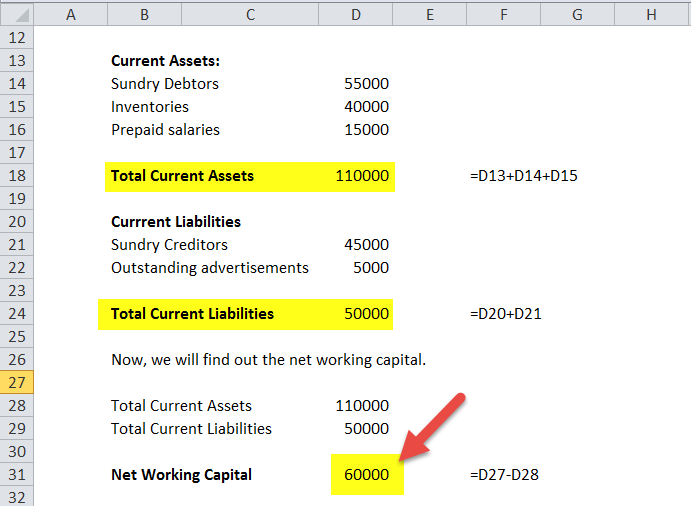

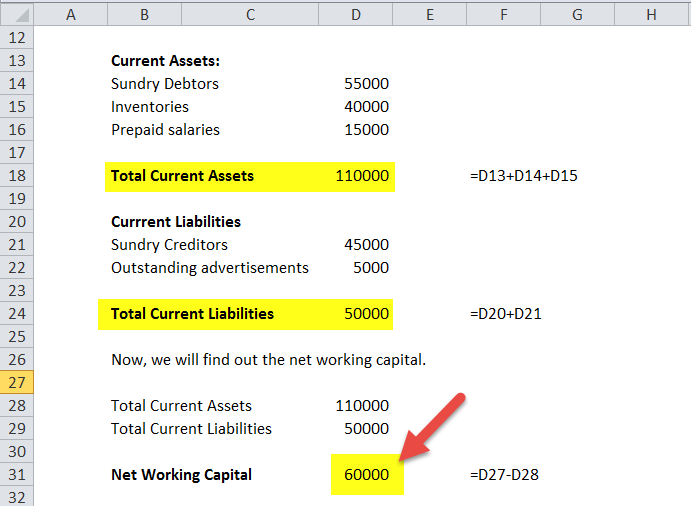

Change in Net Working Capital is calculated as a difference between Current Assets and Current Liabilities. NWC is a measure of a companys. Similarly negative change in net working capital means that.

A change in working capital is the difference in the net working capital amount from one accounting period to the next. Changes in net working capital impacts Operating Cash Flow OCF and is recorded on your cash flow statement. The net working capital figure is more informative when tracked on a trend line since this may show a gradual improvement or decline in the net amount of working capital over an extended period.

Sample 1 Sample 2 Sample 3 Based on 6 documents Remove Advertising. Look closely at the image of the model below and you will see a line labeled Less Changes in Working Capital this is where the impact of increasesdecreases in accounts receivable inventory and accounts payable impact the unlevered free cash flow of a firm. The Change in Working Capital tells you if the companys Cash Flow is likely to be greater than or less than the companys Net Income and how much of a difference there will be.

Changes in working capital simply shows the net affect on cash flows of this adding and subtracting from current assets and current liabilities. This is basically what you need to keep the business open. A management goal is to reduce any upward changes in working capital thereby minimizing the need to acquire additional funding.

So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. Working capital is usually defined as net current assets excluding cash adjusted for any debt-like items such as unpaid corporation tax loans and hire purchase liabilities. But what you really need to know about working capital is how and why it matters.

As a business your aim is to reduce an increase in the Net Working Capital. Net working capital which is also known as working capital is defined as a companys current assets minus its current liabilities. What Does Net Operating Working Capital Mean.

Positive working capital is when a company has more current assets than current liabilities meaning that the company can fully cover its short-term liabilities as they come due in the next 12 months. Examples of Changes in Working Capital If a companys owners invest additional cash in the company the cash will increase the companys current assets with no increase in current liabilities. Current assets - current liabilities.

Working Capital Cycle Understanding The Working Capital Cycle

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Example Formula

Working Capital Example Formula

Change In Net Working Capital Nwc Formula And Calculator

How To Calculate Fcfe From Ebitda Overview Formula Example

Net Working Capital Definition Formula How To Calculate

Net Working Capital Definition Formula How To Calculate

Working Capital Example Formula

What Is Working Capital Cycle Wcc

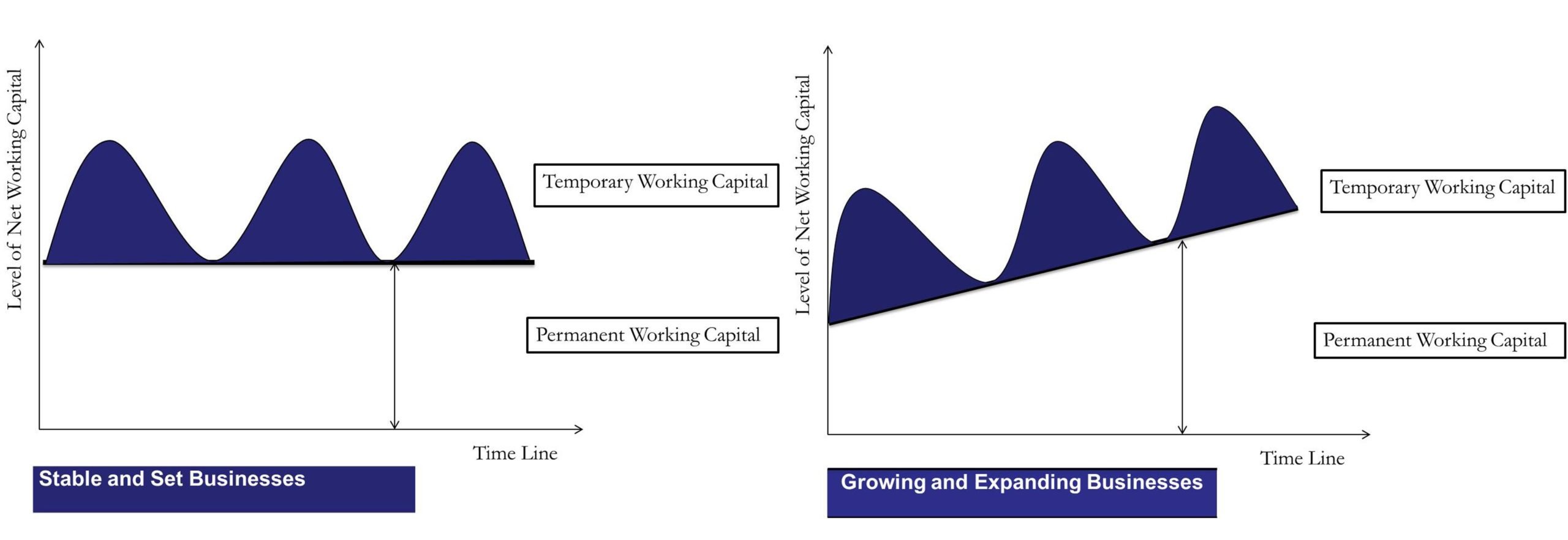

Types Of Working Capital Gross Net Temporary Permanent Efm

Net Working Capital Definition Formula How To Calculate

Working Capital Turnover Ratio Meaning Formula Calculation

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Permanent Or Fixed Working Capital

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)